6 Simple Techniques For Paul B Insurance

Wiki Article

Get This Report on Paul B Insurance

Table of ContentsPaul B Insurance Things To Know Before You BuyPaul B Insurance Can Be Fun For EveryonePaul B Insurance Things To Know Before You Get ThisPaul B Insurance for BeginnersExamine This Report on Paul B Insurance4 Simple Techniques For Paul B InsurancePaul B Insurance Can Be Fun For Anyone

:max_bytes(150000):strip_icc()/how-does-insurance-sector-work.asp-FINAL-1ccff64db9f84b479921c47c008b08c6.png)

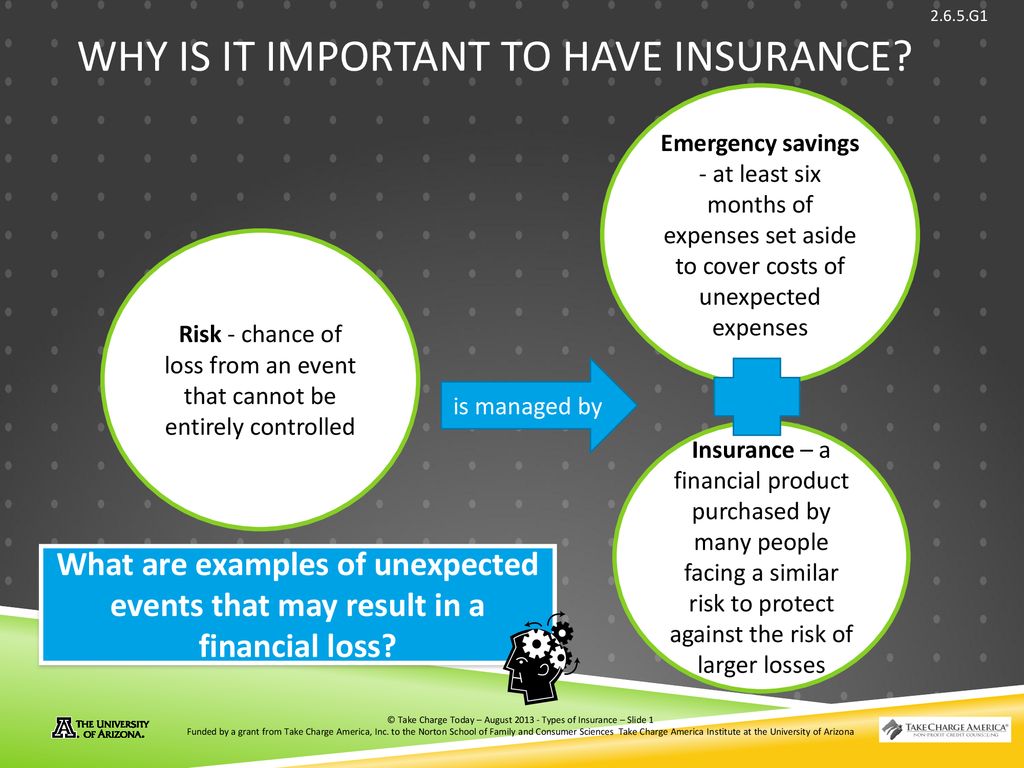

No issue exactly how difficult you try to make your life better, an unforeseen occasion can entirely transform things upside-down, leaving you literally, mentally and financially stressed. Having sufficient insurance coverage helps in the feeling that at least you do not need to believe about cash during such a difficult time, as well as can concentrate on healing.

Having wellness insurance in this case, conserves you the fears and stress and anxiety of organizing cash. With insurance policy in area, any economic stress will be taken care of, as well as you can concentrate on your recuperation.

Our Paul B Insurance Diaries

With Insurance coverage making up a large part of the losses companies and family members can jump back rather conveniently. Insurance policy firms merge a large quantity of cash.

There are generally 2 kinds of insurance policy and also let us comprehend exactly how either is pertinent to you: Like any kind of liable individual, you would have prepared for a comfortable life basis your revenue and also career projection. You as well as your family members will be dreaming of basic things such as an excellent residence as well as high quality education and learning for children.

The Paul B Insurance Diaries

Youngster insurance plans like ULIP and cost savings strategies gain an investment value with time. They likewise offer a life cover to the guaranteed. These plans are best to buy your kid's greater education and also marriage goals. Term life insurance coverage is the pure form of life insurance coverage. Term life cover just supplies a fatality benefit for a restricted period. Paul B Insurance.If you have a long time to retire, a deferred annuity provides you time to invest throughout the years and also develop a corpus. You will certainly obtain revenue streams called "annuities" till completion of your life. Non-life insurance coverage is likewise referred to as general insurance and covers any insurance coverage that is outside the purview of life insurance coverage.

When it comes to non-life insurance coverage policies, variables such as the age of the possession as well as insurance deductible will also influence your selection of insurance policy plan. Permanently insurance coverage strategies, your age as well as health will certainly impact the costs expense of the plan. If you have an automobile, third-party insurance policy coverage is mandatory prior to you can drive it when traveling.

Full Article

The Single Strategy To Use For Paul B Insurance

Insurance is a lawful agreement between an insurance firm (insurance firm) as well as a specific (insured). In this case, the insurance coverage firm guarantees to make up the insured for any type of losses sustained as a result of the covered backup occurring. The backup is the incident that causes a loss. It might be the insurance policy holder's death or the building being damaged or destroyed.

The primary functions of Insurance are: The key function of insurance coverage is to secure versus the opportunity of loss. The time and also quantity of loss are unpredictable, and also if a threat takes place, the individual will sustain a loss if they do not have insurance policy. Insurance policy ensures that a loss will certainly be paid as well as therefore shields the guaranteed from enduring.

The smart Trick of Paul B Insurance That Nobody is Talking About

The treatment of establishing costs rates is likewise based on the policy's threats. Insurance coverage offers repayment certainty in the event of a loss. Much better preparation as well as administration can aid to decrease the threat of loss. In risk, there are numerous kinds of uncertainty. Will the risk occur, when will it take place, as well as just how much loss will there be? Simply put, the occurrence of time as well as the amount of loss are both unforeseeable.There are a number of secondary features of Insurance. These are as complies with: When you have insurance policy, you have assured money to pay for the therapy as you get appropriate financial support. This is just one of the essential additional functions of insurance coverage whereby the general public is shielded from ailments or mishaps.

The feature of insurance is to eliminate the anxiety and suffering linked with death and residential or commercial property devastation. An individual can devote their heart and soul to far better achievement in life. Insurance coverage uses a reward to function hard to better the individuals by protecting culture against huge losses of damages, devastation, and also fatality.

See This Report about Paul B Insurance

There are a number of functions as well as significance of insurance. A few of these have actually been provided below: Insurance cash is bought various efforts like water system, energy, as well as highways, adding to the country's general economic prosperity. Instead than concentrating on a bachelor or organisation, the threat useful source impacts different people and organisations.It encourages risk control action since it is based upon a risk transfer system. Insurance plan can be utilized as security for debt. When it involves a home funding, having insurance policy protection can make obtaining the loan from the lending institution easier. Paying taxes is just one of the major duties of all residents.

25,000 Section 80D People and their family plus moms and dads (Age less than 60 years) Amount to Rs. 50,000 (25,000+ 25,000) Area 80D Individuals as well as their household plus moms and dads (Age more than 60 years) Amount to Rs. 75,000 (25,000 +50,000) Area 80D Individuals as well as their household(Anyone over 60 years of age) plus parents (Age greater than 60 years) Complete Up to Rs.

Some Known Details About Paul B Insurance

All types of life insurance coverage plans are offered for tax obligation exception under the Revenue Tax Obligation Act. The benefit is gotten on the life insurance policy plan, entire life insurance strategies, endowment plans, money-back policies, term insurance coverage, and System Linked Insurance Policy Program. The optimum deduction readily available will be Rs. 1,50,000. The exemption is attended to the premium paid on the plans taken for self, spouse, dependent children, and reliant parents.This provision additionally enables a maximum deduction of 1. 5 lakhs. Every person has to take insurance policy for their health. You can pick from the different types of insurance policy according to your need. It is recommended to have a wellness or life insurance policy check my reference policy considering that they verify valuable in bumpy rides.

Insurance policy promotes relocating of risk of loss from the insured to the insurance provider. The standard concept of insurance coverage is to spread out danger amongst a big number of people.

Report this wiki page